Old buildings and oligarchs

Further inequality, economic growth and the rise of automation, artificial intelligence and virtual reality could increase the long-term economic value of heritage assets.

|

| Heritage at a price: the former Old War Office building is now the London Raffles hotel. Designed by Clyde Young, it was completed in 1906. (Photo: Garry Knight, Wikimedia) |

Contents |

Introduction

Are you feeling flush? Then you might like to consider a short stay in the exclusive London Raffles hotel, formerly the Old War Office in Whitehall. You can stay in the very room once used by Winston Churchill. This deal will not come cheap: a long weekend in an executive room could set you back by about £3,000.

It is often difficult to convince others (not least Treasury economists) of the value of heritage as an economic asset. Heroic and generally unconvincing attempts have been made to quantify the economic benefits of heritage, usually rooted in benefits to tourism, or in approaches that place greater emphasis on ‘wellbeing’ as an economic outcome[1]. But what Winston Churchill’s former office shows is that some people really do value heritage and will pay a great deal to experience or be associated with it.

The rich get richer

Inequality of wealth in many countries has been rising sharply. The rich are getting much richer and those on middling incomes, not to mention the poor, have not. Damon Silvers at University College London’s Institute for Innovation and Public Purpose has drawn the key data together[2]. Inequality in the UK increased sharply under Margaret Thatcher and it has not reduced since.

International inequality has grown sharply since the 1970s. In 2015 the richest 62 people on the planet owned as much net wealth as the poorer half of humanity, more than 3.5 billion people. Inequality is not just generated by the small number of billionaires. The richest one per cent of the world’s population hold a little more than half of all global private net wealth. The USA leads the world in wealth inequality: the wealthiest 20 Americans own as much as the bottom half of the population[3].

In much of the world the rich are getting richer and they have money to spend on whatever they like. What motivates their spending patterns? There are only so many expensive toys or holidays they can consume; beyond that, money has to go into purchasing assets as a store for their wealth. To some extent the desire for status can be secured by buying very expensive cars, yachts or planes. But these baubles are not particularly good investments. Property is a much better proposition. The most high-status property is almost always in the parts of towns and cities with a great deal of heritage.

What oligarchs call wealth

Where does this value originate? In large part it arises because this sort of property is not an ordinary economic product. Status assets like Maserati or Porsche cars can in theory be manufactured in unlimited quantities. As robotics, automation and artificial intelligence take hold, the costs of manufacturing goods will continue to fall and their availability should increase, except where manufacturers constrain production to keep prices up. Even more significant is the fact that benefits from products we used to buy as tangible assets, like CDs and vinyl records, can now be delivered at virtually zero cost, with huge back catalogues available free of charge or at very low cost on Spotify or YouTube. These are useless as status or investment assets.

There is one type of economic asset whose supply cannot be increased. Fred Hirsch identified it in the 1970s, inventing the concept of ‘positional goods’[4]. Hirsch argued that economists saw consumption as a ‘malleable aggregate’: there is a product, whose form can be fashioned by choice and more products can be made. But alongside these products are things which cannot be reshaped without losing their value and cannot be produced in greater numbers, other than as facsimiles. With contemporary technology, some facsimiles can look utterly convincing, with stone statues produced as perfect copies, using computer-controlled cutting machines. Art displayed on a giant video screen may be near perfect in definition and more easily viewed than on a gallery wall. Taking the digital format further, there are ‘non-fungible tokens’, electronic data files associated with a particular asset – digital or physical – such as an image, art or music. These can apparently be traded, but the extra-legal nature of trading usually results in informal exchange, which has no legal basis for enforcement. One way or another all these are copies, facsimiles or fakes.

The examples of positional goods used by Hirsch include a Rembrandt painting or access to a natural landscape (and the status secured by occupying one of society’s top slots). Works of art, antiquities and, to some extent, top jobs are globally mobile, whereas buildings, places and landscapes are place-specific and contextual. They cannot be shifted around by buyers. The historic environment has evidential, historical, aesthetic, communal, cultural, social and environmental value, all of them distinct from one another. Shifting an entire building might just be possible, but a change of location loses the historic context, the relationship with other structures, community, topography and history – and thus its authenticity as a place.

The economist Sir Roy Harrod first put his finger on the issues in the 1950s[5]. Harrod referred to the unbridgeable gulf between what he termed ‘oligarchic wealth’ and ‘democratic wealth’ (terms that seem peculiarly apposite to our current condition). Democratic wealth gives command over resources at a particular time to everyone. It is limited only by productivity. Oligarchic wealth is available only for a few, whatever the general level of productivity.

Oligarchic wealth (or positional goods) comes first into the hands of the already rich, at a time when others need to spend their hard-earned cash on everyday material goods. The already rich can subsequently make capital gains on their positional assets. One example of this is the ownership of land in central London, which for the most part rests with great estates, some of which go back to the Norman conquest[6].

No status in virtual reality

As wealth grows, there is increased demand for living in positional good environments that are socially or physically scarce – and the increased pressure can damage the experience originally available. The consequence is exclusion through planning controls, alongside exclusion by price. As a side effect, wealth is redistributed in favour of those who bought in first, at the expense of those attempting to move in later. This usually means wealth moving from the poor to the rich.

Hirsch confines his examples mainly to landscapes, exclusive suburbs and old masters. But it is clear enough that heritage assets, whether buildings, parklands or, indeed, entire historic places are excellent examples of positional goods. The effect is not confined to the wealthiest places. It is no accident that Grosvenor’s hugely successful Liverpool One investment (purchased in 2024 by Land Securities) is surrounded by heritage assets, or that the urban designers went out of their way to carefully site buildings and reduce roof heights, to preserve views out to heritage landmarks and secure a sense of place.

In the future (as noted), manufactured goods will be produced increasingly cheaply, thanks to robotics and automation. What is more, many products may have no physical dimension. For philosophers like David Chalmers, virtual reality is as valid as genuine reality[7]. Artificial intelligence and virtual reality raise the bizarre prospect of a totally private world, where a helmet can be donned and the user can live a life of virtual reality. You can live in a polluted slum but just don the helmet and AI will take you to a beautiful place. According to Chalmers, virtual worlds are not second-class worlds and we can all have a meaningful life in this alternative universe. But virtual products, like facsimiles, are entirely without status and exclusivity. They are not of value as a store of wealth or a source of status.

Heritage grows in value

As time passes and inequality increases, the rich are looking for assets and experiences that others cannot have, confident in the knowledge that assets in short supply can only increase in value. The rich will be looking for the best-quality positional goods: exceptional houses, estates, landscapes and, above all, unique historic places. These are places they will want to enjoy, occupy, visit, shop in and own. It is the heritage sector that identifies the assets, protects them from deterioration, and (by reducing user pressures) can exclude those who are late into the game.

Partly because of its long rich history as the centre of a vast empire, Great Britain is well endowed with such assets, their condition and setting carefully protected and policed by the planning system as listed buildings, registered parklands, national parks, national landscapes, scheduled ancient monuments, conservation areas and world heritage sites.

What does this mean for conservation professionals? On the one hand they might feel complicit in protecting assets overwhelmingly valued and owned by the rich. But heritage assets have always been the privilege of the rich. And the benefits to conservation may be immense. If the rich value historic assets, they are likely to purchase them, use them and invest in them, either as land and property owners, or as philanthropists. Because the rich value historic assets, they will support and campaign for effective protection, especially since the need to care for heritage assets and enhance their financial value is likely to extend beyond the assets themselves to their context and setting. Owners have a vested interest in ensuring that their asset is not harmed by insensitive, low-quality development in the neighbourhood. This could drive up the quality of new and sympathetic design in historic areas.

As asset values rise, the economic case for investing in heritage should rise accordingly. The use of heritage as a vehicle for city image projection, for tourism and for wider property investment will grow. Attracting the global rich as investors, visitors or residents brings their wealth, ideas, connections and tax revenues. Heritage, a uniquely significant national asset, is more likely to be perceived as having economic value in the future than the past. Unlike works of art, it cannot be moved out of the country. It will increase in both monetary and intrinsic value.

References

- [1] Since 2018 the UK’s HM Treasury has placed greater weight on wellbeing as a core economic outcome in its revised publications of the Green Book, the framework under which government departments make investment decisions, but the chancellor’s recent speeches have emphasised traditional valuations of GDP growth. See also Thomas Colwill and Adala Leeson (2025) ‘The economics of health and wellbeing’, Context 183, March.

- [2] Damon Silvers, Understanding neoliberalism as a system of power, https://www.youtube.com/watch?v=hLtkJ-AgLuY

- [3] Walter Scheidel (2017) The Great Leveller, Princeton University Press.

- [4] Fred Hirsch (1977) Social Limits to Growth, Routledge and Kegan Paul.

- [5] Roy Harrod (1958) The Possibility of Economic Satiety: use of economic growth for improving the quality of education and leisure in Problems of the United State Economic Development, Committee for Economic Development, New York.

- [6] See Ian Wray (2026) Great British Plans, Routledge, Chapter 2 on London’s roads and squares.

- [7] David Chalmers (2022) Reality+: virtual worlds and the problems of philosophy, Allen Lane.

This article originally appeared in the Institute of Historic Building Conservation’s (IHBC’s) Context 184, published in June 2025. It was written by Ian Wray, the author of Great British Plans, an honorary professor at Liverpool University’s Heseltine Institute and professorial fellow at Manchester University’s Planning School. He is grateful for comments on this paper from Peter de Figueiredo, Henry Owen John, Rob Cowan and Katie Wray.

--Institute of Historic Building Conservation

Related articles on Designing Buildings Conservation.

IHBC NewsBlog

RICHeS Research Infrastructure offers ‘Full Access Fund Call’

RICHesS offers a ‘Help’ webinar on 11 March

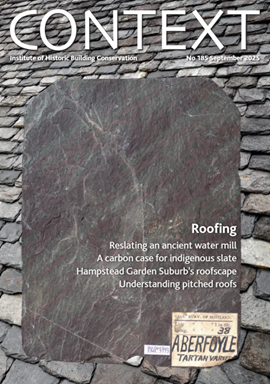

Latest IHBC Issue of Context features Roofing

Articles range from slate to pitched roofs, and carbon impact to solar generation to roofscapes.

Three reasons not to demolish Edinburgh’s Argyle House

Should 'Edinburgh's ugliest building' be saved?

IHBC’s 2025 Parliamentary Briefing...from Crafts in Crisis to Rubbish Retrofit

IHBC launches research-led ‘5 Commitments to Help Heritage Skills in Conservation’

How RDSAP 10.2 impacts EPC assessments in traditional buildings

Energy performance certificates (EPCs) tell us how energy efficient our buildings are, but the way these certificates are generated has changed.

700-year-old church tower suspended 45ft

The London church is part of a 'never seen before feat of engineering'.

The historic Old War Office (OWO) has undergone a remarkable transformation

The Grade II* listed neo-Baroque landmark in central London is an example of adaptive reuse in architecture, where heritage meets modern sophistication.

West Midlands Heritage Careers Fair 2025

Join the West Midlands Historic Buildings Trust on 13 October 2025, from 10.00am.

Former carpark and shopping centre to be transformed into new homes

Transformation to be a UK first.

Canada is losing its churches…

Can communities afford to let that happen?